Insider Buying Report: Pernod Ricard SA (RI:FP)

Insider transactions can give investors a more complete view of activity within the world’s publicly-listed companies. No one has more information in relation to a company’s prospects than its leaders.

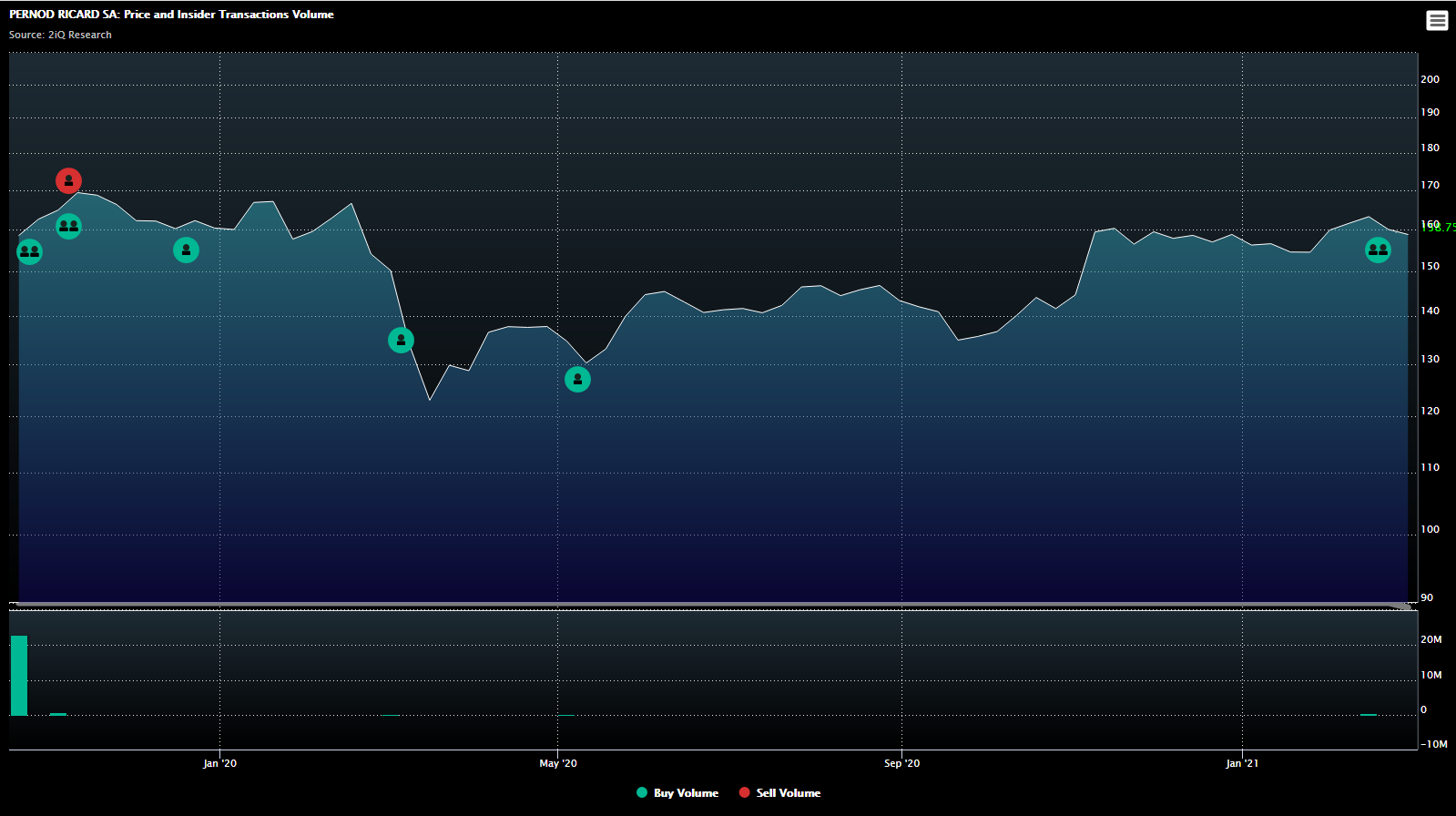

In this report, we are going to highlight some interesting insider buying at Pernod Ricard SA (RI:FP). Pernod Ricard is a French alcoholic beverages company that owns a number of well-known brands including Absolut vodka, Chivas Regal, Jameson, and Kahlua. The stock is listed on the Euronext Paris and currently has a market capitalization of €41.9 billion.

Pernod Ricard: Insider Buying

Our data shows that on 19 February, family holding company Société Paul Ricard purchased 1.72 million Pernod Ricard shares at a price of €163.82 per share. This purchase was worth approximately €282 million.

Our data also shows that on 15 February, Chairman and CEO Alexandre Ricard purchased 2,208 shares at a price of €160.86 per share. This purchase cost the insider approximately €355,000.

Insider Expertise

This insider activity is worth highlighting due to the fact that both Société Paul Ricard and Alexandre Ricard are likely to have an in-depth understanding of the company’s recent performance and future prospects. Société Paul Ricard – a holding company set up by the Ricard family – is the company’s largest shareholder. Alexandre Ricard, meanwhile, is the grandson of Mr. Paul Ricard, the founder of Société Ricard. He was appointed Chairman and CEO of the group by the Board of Directors in 2015.

A Return to Growth in H2

Pernod Ricard continues to be impacted by Covid-19 restrictions. For the six month-period to 31 December 2020, for example, organic sales growth was -3.9%.

Looking ahead, however, the group expects performance to improve. Recently, it advised that it expects organic sales growth in the second half of its fiscal year 2020/21 to "more than offset" the 3.9% decline of the first half, and that it expects to return to organic sales growth for full-year FY21, due to its dynamic performance in the USA, China and India.

“We are particularly encouraged by our must-win domestic markets returning to growth in H1 FY21. The first half confirms the long-term sustainability and underlying strength of our business,” commented Chairman and CEO Alexandre Ricard. “Thanks to our solid fundamentals, our teams and our brand portfolio, I am confident that Pernod Ricard will emerge from this crisis stronger,” he added.

In light of this outlook, we see the insider buying here as a bullish signal.

Latest Stories

NowVertical Group's Leadership Bets Big on Company's Future

From Insider Buys to Stock Rallies: The 2024 Confidence Playbook

Form144s Reported at Innodata Inc. Whilst Insiders Under Investigation for Misconduct

Stolt Nielsen: A Look at Insider Trades, Leadership & Market Expansion

SharkNinja Wang Xuning’s $210M Stock Sale Amid Short-Seller Claims